Thousands of Pakistani workers rely on the Employees’ Old-Age Benefits Institution (EOBI) for financial security after retirement. Yet, many people still don’t fully understand their EOBI pension rights, eligibility rules, or how to claim benefits.

With rising inflation and economic pressure, awareness of EOBI benefits has become more important than ever. Here’s a clear and updated guide to help workers and employers understand their rights and responsibilities.

What Is EOBI and Why It Matters?

The Employees’ Old-Age Benefits Institution (EOBI) is a federal government scheme designed to provide social security to private-sector workers.

It offers financial protection in old age, disability, or after the death of an insured person. The scheme is mandatory for registered employers and ensures workers don’t face financial hardship after retirement.

Who Is Eligible for EOBI Pension?

Basic Eligibility Criteria

To qualify for EOBI benefits, a worker must:

-

Be employed in a registered private-sector organization

-

Have at least 15 years of contributions

-

Reach the retirement age

-

60 years for men

-

55 years for women

-

Important Note for Workers

Even daily wage earners and low-income employees can qualify if their employer is registered with EOBI and regularly pays contributions.

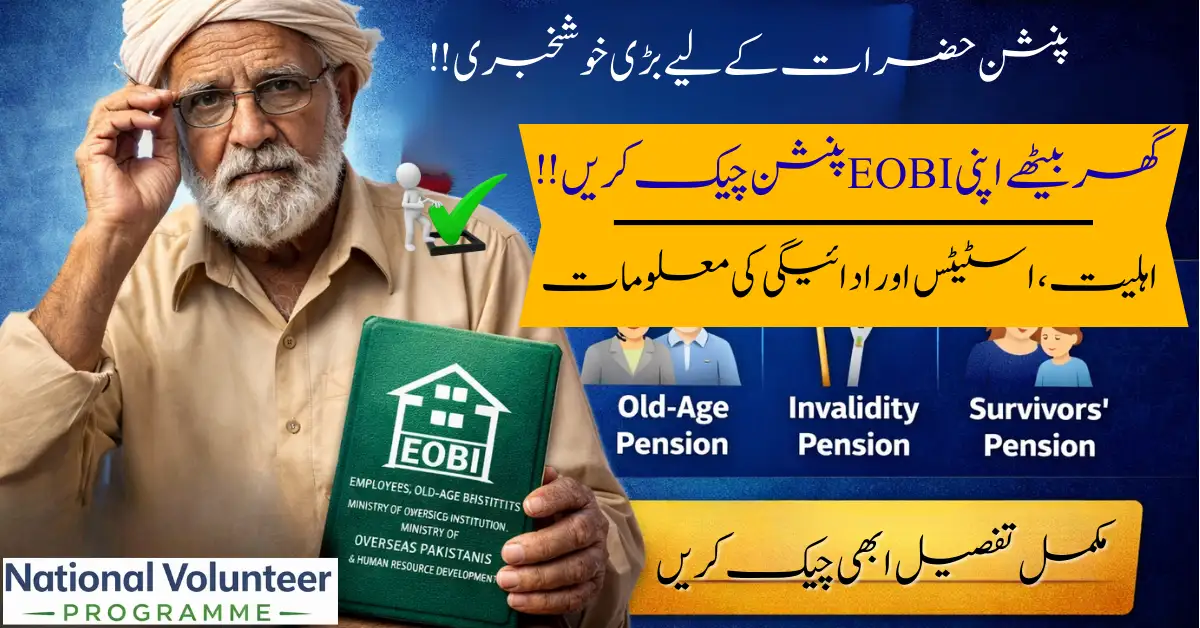

Types of Benefits Under EOBI

Old-Age Pension

This is the most common benefit. Eligible workers receive a monthly pension after retirement to support basic living expenses.

Invalidity Pension

If a worker becomes permanently disabled before retirement age, they may qualify for an invalidity pension.

Survivors’ Pension

In case of death, the legal heirs or spouse can receive a monthly survivor pension, ensuring family support.

Old-Age Grant

If a worker does not complete 15 years of contributions, they may receive a lump-sum grant instead of a pension.

How Much Pension Does EOBI Pay?

The pension amount depends on:

-

Total years of contribution

-

Declared wages

-

Government-notified minimum pension rates

The government has revised minimum pension amounts multiple times to protect retirees from inflation, making EOBI pension rights even more valuable today.

How to Apply for EOBI Pension in Pakistan

Step-by-Step Process

-

Verify your EOBI registration and contribution record

-

Collect CNIC, service certificate, and employer verification

-

Submit the pension claim form to the nearest EOBI office

-

Biometric verification may be required

-

Receive approval and monthly payments through bank or payment system

Workers are advised to apply 3–6 months before retirement to avoid delays.

Latest Updates & Awareness for Workers

Recent government discussions emphasize improving pension coverage and digitizing records. Officials have also urged employers to register workers properly, as unregistered employment is the biggest reason people lose their EOBI pension rights.

FAQs About EOBI Pension Rights

1. Is EOBI mandatory for private employers?

Yes, it is legally mandatory for eligible private-sector employers.

2. Can contract workers get EOBI pension?

Yes, if their employer registers them and pays contributions.

3. What if my employer didn’t pay EOBI contributions?

You can file a complaint with EOBI and provide employment proof.

4. Is EOBI pension for government employees?

No, it is mainly for private-sector workers.

5. Can family members receive EOBI pension after death?

Yes, eligible survivors can receive a monthly pension.